Other Names: Stop Payment Request

If a check's gone missing or you need to stop check payment for some other reason, a stop payment on check letter will tell your bank to halt the payment process. Write the letter as soon as you know the check was lost, stolen, or you need to stop payment for another reason. Once the bank stops the payment, you can reissue a new check if needed.

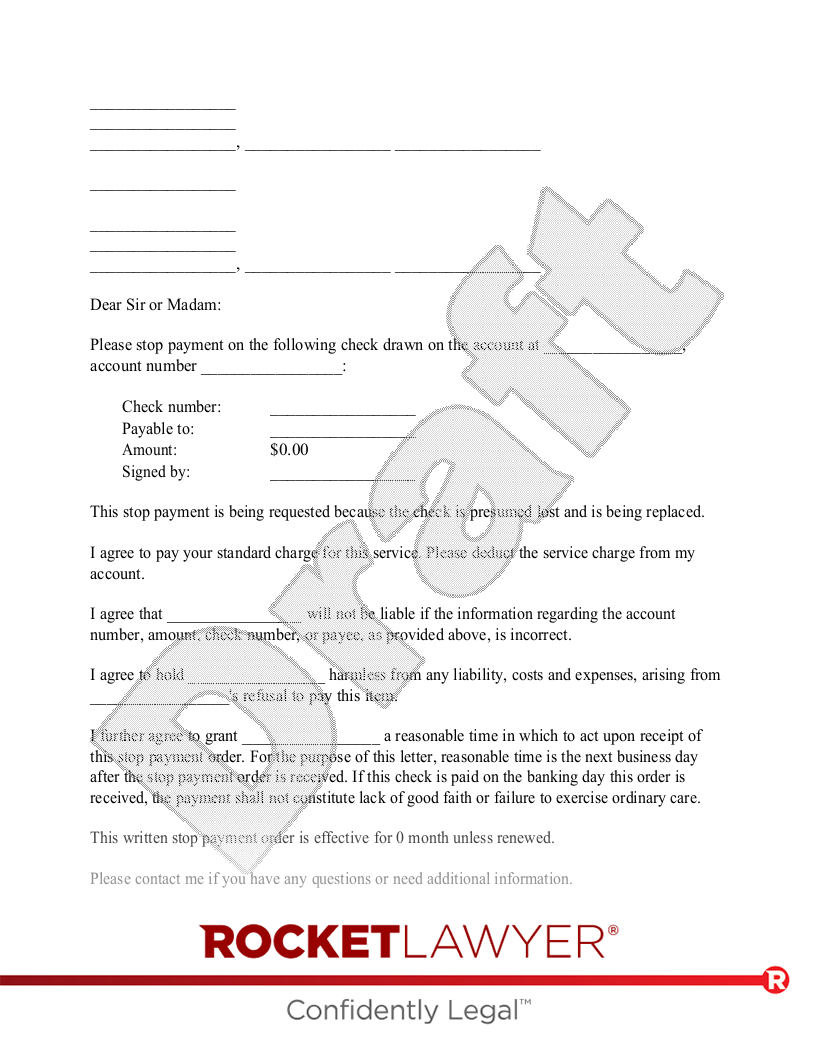

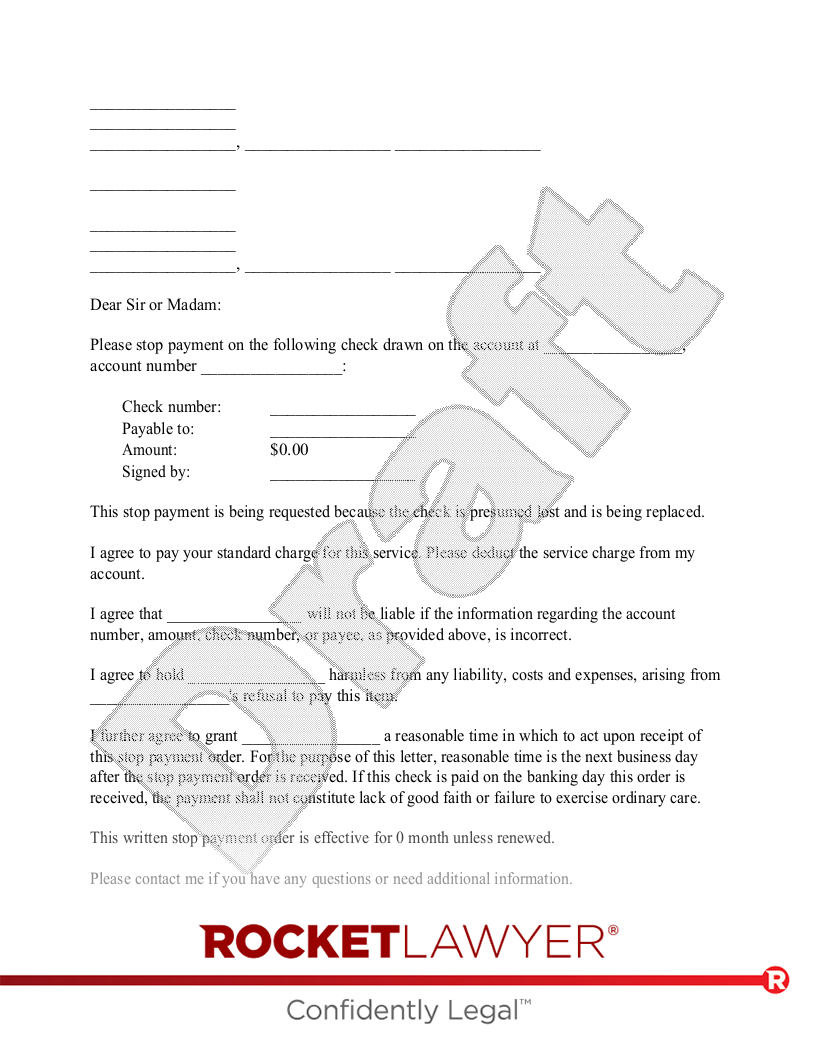

Use a Stop Payment on Check Letter to notify your bank that you want them to stop payment on a check you wrote. Maybe the money is no longer owed, or your check was misplaced by the recipient, or perhaps it's a fraudulent check. Whatever the case, alert the bank as soon as possible, especially if you'll need to reissue a new check. Your dated stop payment letter should include details like: the name and address of the account owner, the bank or credit union's address, the account number, check number, date, amount, the signer, and the payee; an explanation for the stop payment order (e.g., the check is presumed lost, it's not authorized, or there's a legitimate service complaint on a purchased item); how long the stop payment order will be effective; and more. You'll need to determine the bank's liability and your own responsibility for costs and expenses. Banks require "reasonable time" to act on the order, so don't delay.

This document has been customized over 5K times

Ask a lawyer questions about your document